Hedging 201 – Part Two: Spreads

Our goal for Hedging 201 is to take things a little bit farther. Building on the foundational terms and concepts introduced in our first series, Hedging 101, we want to show how using different financial tools can benefit your business.

In our previous post, we discussed a forward curve structure. We talked about how the structure of a forward curve helps tell a commodity’s story. We also discussed the part a spread (particularly a time spread) plays in interpreting that story.

Spreads Defined

Investopedia defines it this way: “a spread . . . typically refers to some form of difference or gap between two related values.” A spread shares essential information. As it shifts higher or lower, the spread helps shed light on the overall condition of the market. By identifying and tracking several key relationships between certain timeframes, spreads can give us a relative indication of how strong or weak the market really is.

What Spreads Do

Reminder: Time Spread – the difference between two months on a forward curve.

Physical time spreads basically tell large storage-holders what to do. In the energy industry, these might refer to oil and refined products suppliers with a storage position. In the agricultural field, the commodity might refer to wheat or corn, and the storage facility would be a grain elevator.

Time spreads act like a thermometer, gauging the “temperature” of the market. For example, if the market is in backwardation, the spread is telling the storage-holder: “I am willing to pay a premium for your product now vs. later. I need the barrels; bring your product to market.”

However, if the market is in contango, the spread is telling the storage-holder: “You are better off carrying your product for 3-6 months. You will recognize a greater market price later for your barrel.”

Please note that there is no mention of the flat price or absolute value of the commodity in these examples. Instead, these examples highlight the month-to-month relationship and the differences between futures contracts and potential delivery months. In other words, they illustrate the importance of the spread!

Important Time Spreads in Propane

When looking at the forward curve for propane there are certain time spreads that are important. A few of these are listed below.

- July vs. January Mt. Belvieu

- Quarter 1 vs. Quarter 2

- March vs. April

- January vs. February OR February vs. March (for heating oil futures, traders will look at either of these two pairs of months)

Examples of Spreads

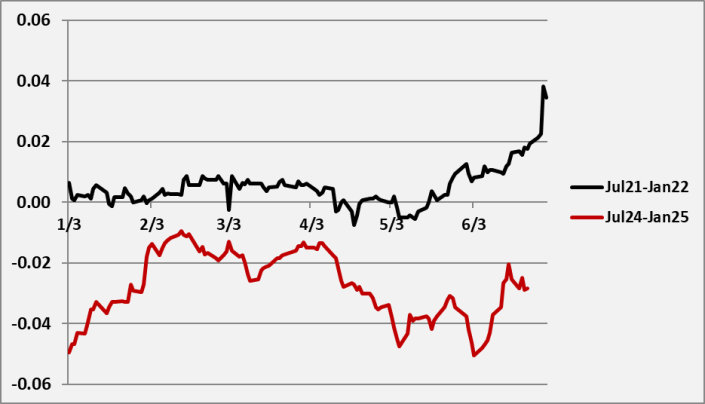

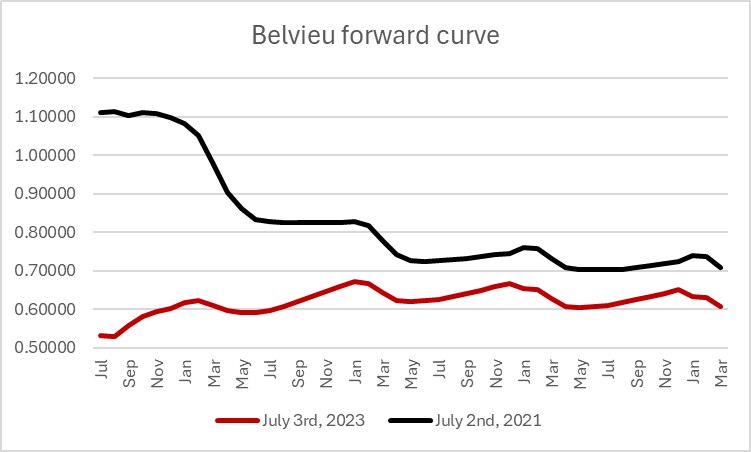

For this example, I would like to compare the Mt. Belvieu July vs. January spread from 2021 with the same spread from 2023.

It’s not a coincidence that these were the Mt. Belvieu values in July:

2021 July 2nd $1.11125

2023 July 3rd $0.5375

And these were the Inventory Amounts:

2021 June 25th 54.479m bbls

2023 June 30th 81.119m bbls

Review of Terms

- Spread – typically refers to some form of difference or gap between two related values

- Forward Curve – a set of commodity prices at a specific location (Belvieu/Conway) at future specified contract months

- Time Spread – the difference between two months on a forward curve

- Contango / Carry – where the current/prompt month is selling for less than future months (weaker market)

- Backwardation – where the current/prompt month is selling at a premium in relation to future months (stronger market)

Summary

The greater the backwardation, the higher the prices.

The greater the carry (or less backwardation), the lower the prices.

Check our website over the next several weeks, as we continue exploring more topics related to hedging. You can find our first hedging series here – Hedging 101.

Hedging 201 – Part Two: Spreads

By Matt Adams