Guyana – A Developing Energy Market – Part Two

Last month we introduced our study of the growing oil and natural gas production taking place in Guyana (Part One). This month we want to continue with Part Two in that series and explain how growth in both of those commodities could impact the propane markets.

Authorization for production of offshore oil and natural gas

At the end of October 2023, Guyana government entities released the first results of a bidding process which began in December 2022. This process was designed to encourage companies to create and submit plans for developing production sites off the coast of Guyana. Development of these areas and increased production of oil and natural gas will occur in stages. Several companies received authorization for developing these sites. Some of the companies involved in exploration of these areas are in the table to the right.

- First Stage

- Exxon Mobile

- Hess

- cgx Energy

- Total Energy

- Tullow

- Repsol

- JHI

- Chevron

- Kosmos

- Apache

- Petronas

- Cepsa

- Noble Energy

- Cairn

- Equinor

- Frontera

- China National Offshore Oil Corporation

- Second Stage

- SISPRO Inc

- Total Energy/Qatar Energy Int/ Petronas

- International Group Investment Inc

- Liberty Petroleum Corp/Cibele Energy Limited

- Exxon Mobile

- Hess

- China National Offshore Oil Corporation

- Delcorp Incorporated/Arabian Drilling CO.

- Kosmos

- Apache

- Petronas

- Cepsa

- Noble Energy

- Cairn

- Equinor

- Frontera

- China National Offshore Oil Corporation

Predicted growth in NGL industry

With this coming increase in production of oil and natural gas, there will be a significant increase in the volume of natural gas liquids (NGLs) to be processed. Based on government analysis of all future inversions and plant projects, the amount of NGLs Guyana will produce in the coming years looks like the figures listed below.

- 2024 – 50 MMSCFD – LPG: 3,430 bbl/d – Internal Consumption (Industrial & Domestic)

- 2030 – 200 MMSCFD – LPG: 13,764 bbl/d – Internal & Export

- 2035 – 400 MMSCFD – LPG: 27,528 bbl/d – Internal & Export

- 2040 – 600 MMSCFD – LPG: 41,292 bbl/d – Internal & Export

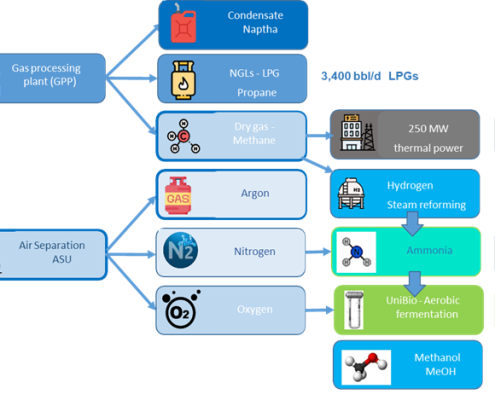

Potential uses for natural gas and NGL products

What are the potential uses for this increased volume of natural gas and NGL products? Below is a diagram showing potential uses for natural gas and NGL products:

Opportunities in Guyana’s developing energy market

As Guyana oil and natural gas production keep increasing, several opportunities can arise from this growth.

- Guyana could become a major producer within the Western Hemisphere.

- There could be export potential of both LNG and NGL products,

- As well as an increase in domestic consumption of natural gas and NGL products.

- Which will lead to a need for additional fractionation, export, and pipeline infrastructure in the country,

- And a growing regulatory framework to address all of this growth.

Impact on the global energy market – propane markets

We started this post with the intent to show how Guyana’s growth could impact the propane markets. Growing NGL production will increase production of propane, and that growth will likely necessitate exporting propane. Propane moving into different South American nations or even into Caribbean islands will decrease the amount of U.S. Gulf Coast product to those areas. In addition, this could create pricing arbitrage situations between the Guyana production and U.S. Gulf Coast production.

None of these shifts will take place overnight and all of them depend on the production and infrastructure development within Guyana. But the Twin Feathers team will be watching these changes and keeping clients updated on how supply and pricing trends begin to change.

Guyana – A Developing Energy Market – Part Two

By Gabriel Amundarain