Brazil – A Changing Energy Market – Part Two

Last month we introduced our exploration of the changing energy market in Brazil (Part One). We discussed the country’s increasing demand for natural gas coupled with a decrease in production. This month we continue with Part Two in that series, explaining how these shifts could impact the global propane markets.

Brazil’s Growing Demand for LPG

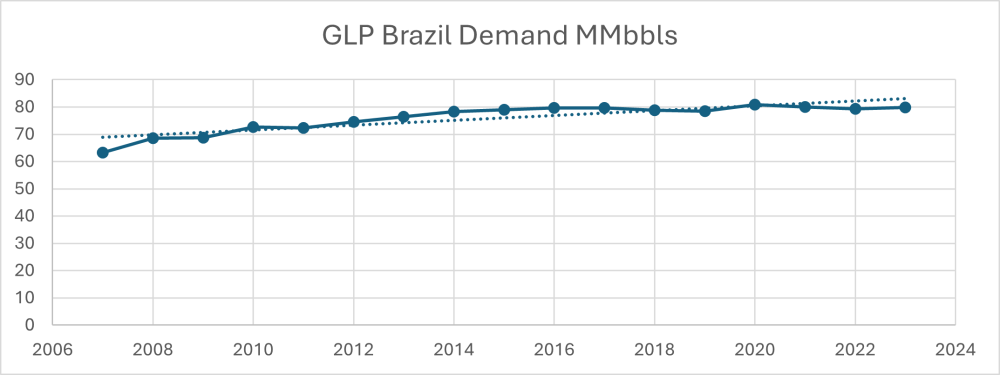

Brazil is the largest consumer of LPG in Latin America, with a demand of about 7.5 million metric tons per year (80.8 MMbbls/Year). Demand growth has been maintained over the last decade, reaching year-on-year growth of up to 3%. This growth is expected to be sustained and estimates project a ceiling in 2027 where it could reach about 8.7 MM Tonne.

Sources of LPG

Brazil’s LPG supply comes from three main sources.

- Processing and fractionation of natural gas.

- Oil refining processes. (Brazil has more than 14 refineries to produce gasoline and derivatives.)

- Imports of LPG.

Declining LPG Production

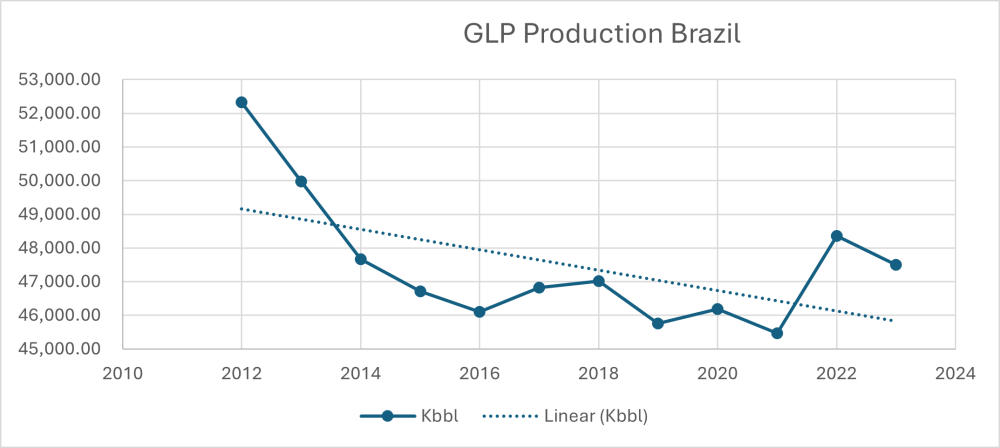

Brazil’s LPG production is declining. There are several reasons for this decrease, a few of which are listed below.

- Reduced availability of internal sources.

- Due to the reduction in natural gas production, there is an intense need to use natural gas to maintain pressure levels in deposits.

- Constantly shifting demand for other products derived from refining, such as propylene.

- International demand for and prices of propylene (and other products) exert significant pressure on markets which can supply it.

- Asia is an example of one large international market which uses propylene in its petrochemical (plastic) industry.

These reasons, and many others, are why LPG production in Brazil has been declining in recent years. The chart below illustrates this decline.

LPG Use and Focus on Cleaner Energies

In Brazil, the domestic market for LPG consists largely of its use as a residential fuel, with values that can exceed 75% of demand. Following this category, LPG is used in industrial areas and as AutoGas, but these categories could go unnoticed when compared with residential consumption. Residential and commercial consumption together account for almost 90% of the market.

We have mentioned before that Brazil contains one of themost important hydrographic basins and tropical forests in the world (Amazon Basin). To protect this environmental treasure is the reason for the intense environmental protection programs and why the change to cleaner energies has special attention in this country.

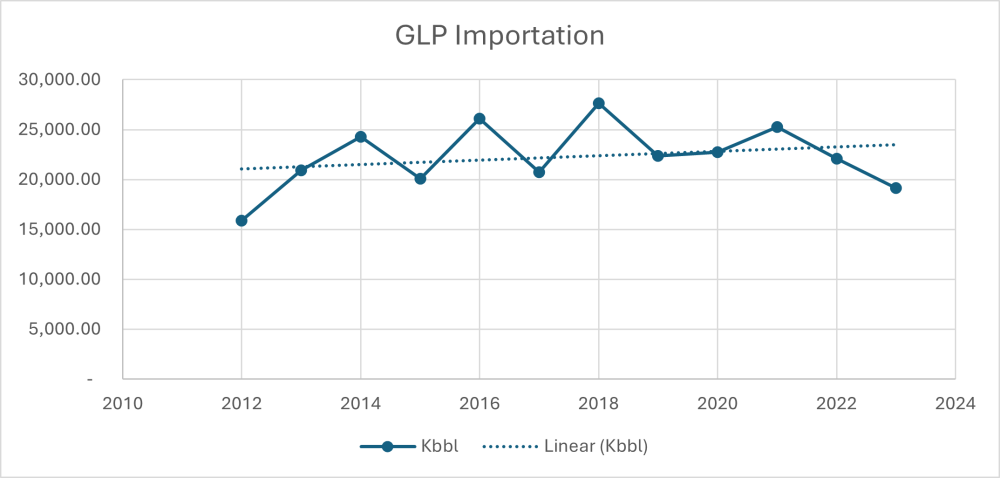

Increasing LPG Imports

Brazil has consistently imported significant volumes of LPG gas from the United States for the past decade. With volumes exceeding 25 MM bbls per year, Brazil can meet their domestic demand. These imports allow the country to move toward cleaner energy and supports population growth. Below we can see how the import of gas has increased since 2012.

Brazil’s LPG Prices Use Mont Belvieu as Standard Reference

When comparing Brazilian LPG prices with those of international markets, we see as a reference or price reference point with Mont Belvieu. We find that it is directly correlated with international standards and local prices are related to global trends. On the other hand, the Brazilian government implemented temporary fuel subsidies for low-income households in 2022, but these subsidies are no longer available or in effect.

The Changes in Brazil’s Energy Market

Conclusions

The LPG market in Brazil faces an increasing demand along with a decrease in domestic production. The country needs substantial imports to meet their internal demand, which is driven by their residential sector. For the past decade, Brazil has met their demand for LPG by importing significant amounts from the United States.

The behavior of global markets has also affected and may continue to affect Brazil’s domestic demand and production of LPG. For example, the spectacular growth in petrochemical consumption by Asian markets over the past five years has influenced Latin America’s position as a price-taker.

Meanwhile, international prices make doing business inside Brazil more feasible. Latin American countries, especially Brazil, reference Mont Belvieu as a price benchmark, closely correlating local prices with global trends.

Additionally, changes in other regional markets, like Guyana, could impact Brazil’s future imports of LPG. Importing LPG from a region that is much closer to Brazil could potentially decrease import amounts from the United States, allowing prices of LPG in Brazil to improve due to logistical changes.

In summary, the Brazilian LPG market faces challenges related to prices, infrastructure, and growing imports. The Twin Feathers team continues to watch the changes occurring in this market and will keep you up to date on global trends as well as local dynamics. As always, our goal is to provide you with expert advice that helps you make smart decisions every day.

Brazil – A Changing Energy Market – Part Two

By Gabriel Amundarain