Hedging 201 – Part Three: Understanding Spreads Helps Assess Hedging Risks

We began our Hedging 201 series with a section titled “Telling the Commodity’s Story”. Our goal in that section was to help show how price spreads can share important information about a commodity, both historical and predictive of the future. Throughout our earlier posts, Parts One and Two, our focus remained on an energy commodity – propane.

Hedging Principles Apply to All Commodities

However, the definitions and principles we discussed, can be used across all commodities. We can demonstrate this point by using copper.

Hedging 201 Principles in Action

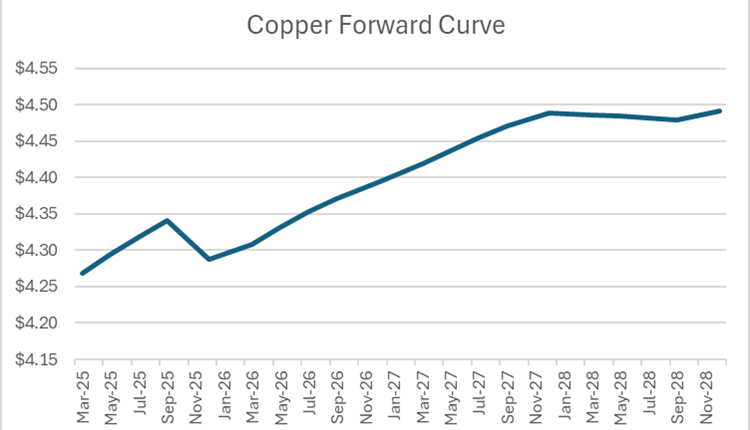

This graph is a snapshot of forward copper prices as of December 9, 2024. It demonstrates the time spread principles we examined in Hedging 201: Part Two. Our curve snapshot tells us that the May 2025 contract is below the December 2028 contract. Even if we knew nothing about copper, we could look at this curve and make these two simple statements:

- The forward curve is in Contango and. . .

- Copper may be bearish because of the contango forward curve

Pick your commodity. The fundamental principles examined in Hedging 201 will still hold up.

Knowing a Commodity’s Story Can Help You Assess Your Hedging Risks

Once you’ve isolated what story the spreads are telling you about a specific commodity, you can then decide how that story may impact your hedging risks. As we identified in Hedging 101, these risks can include things like margin erosion, fixed price risk, and market risk.

After assessing the risks. you are in a position to make a decision. How will you handle the risks facing your business? Will you employ one of the tools we discussed in Hedging 101 (Futures or Financial Swaps)? Or do you need to do something different?

Twin Feathers – New Hedging Series in 2025

There is a different hedging tool that you could use in situations like the one we looked at in this post. That tool will be featured in our Hedging 301 series, coming in 2025.

Twin Feathers is committed to providing our clients with expert, market-based research, so that they can make smart, informed decisions every day. We appreciate the opportunity to share some of that same expertise with a wider audience through our website. Keep watching as we share more hedging tools and building blocks to help you effectively mitigate market risk.

Hedging 201 – Part Three: Understanding Spreads Helps Assess Hedging Risks

By JD Buss