Potential In Colombia’s Energy Market.

This week we continue our exploration of Colombia – a major energy market in South America. We take a closer look at the country’s growing usage of natural gas and LPG, their decrease in domestic production of these products, and their increasing need for imports in the near future. Click here to read Part One of our series.

LPG Cost In Colombia.

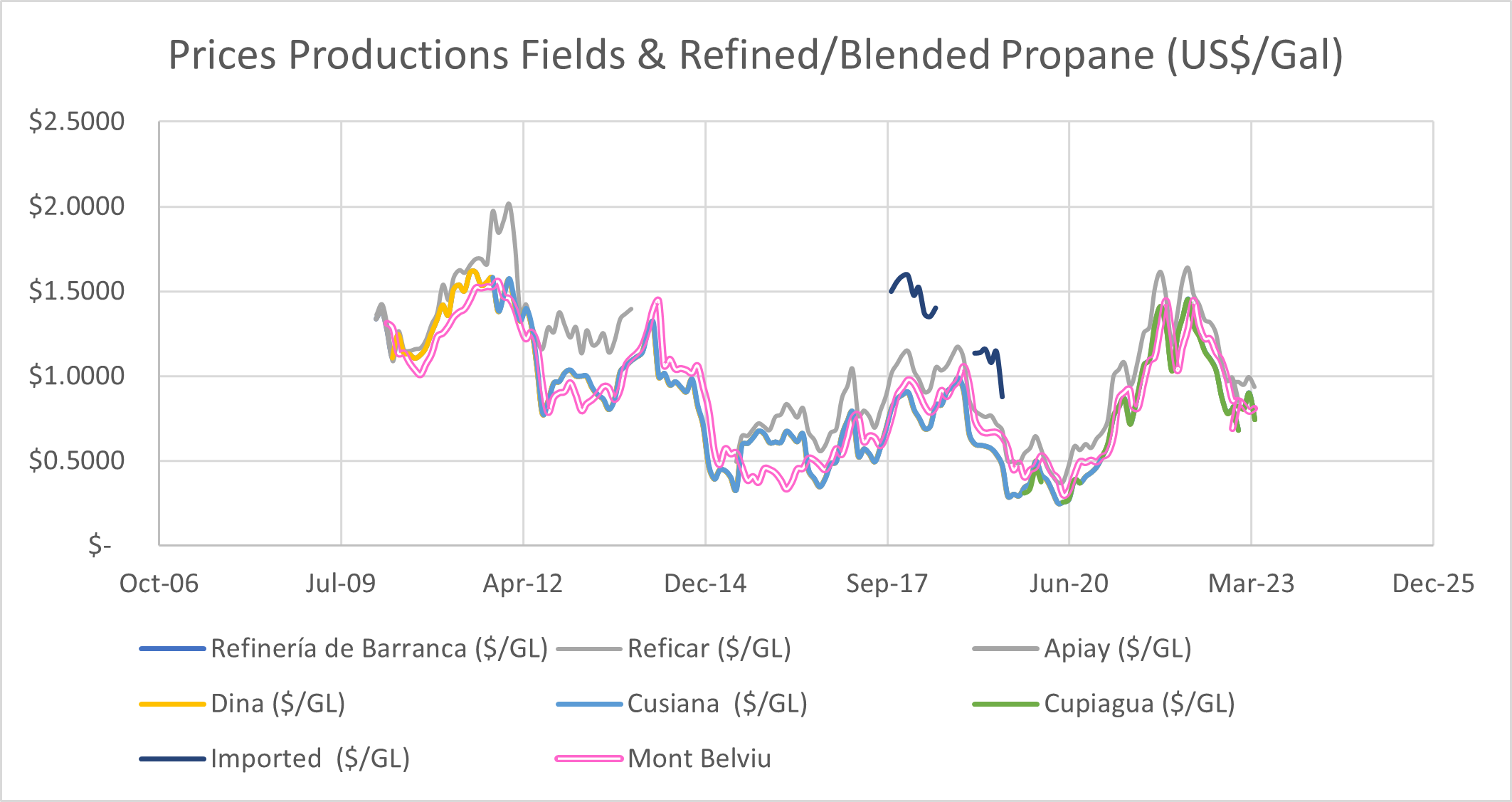

From the beginning of 2010 to the present day, the related costs of LPG in Colombia have an interesting correlation with international price indicators (Mont Belvieu). This correlation indicates that the local Colombian prices are related to the international markets. Below we share how the internal price values of LPG gas has developed in the last 10 years.

Colombia LPG Projection, Demand, And Imports.

Colombian Government (UPME) Published Projected LPG Demand.

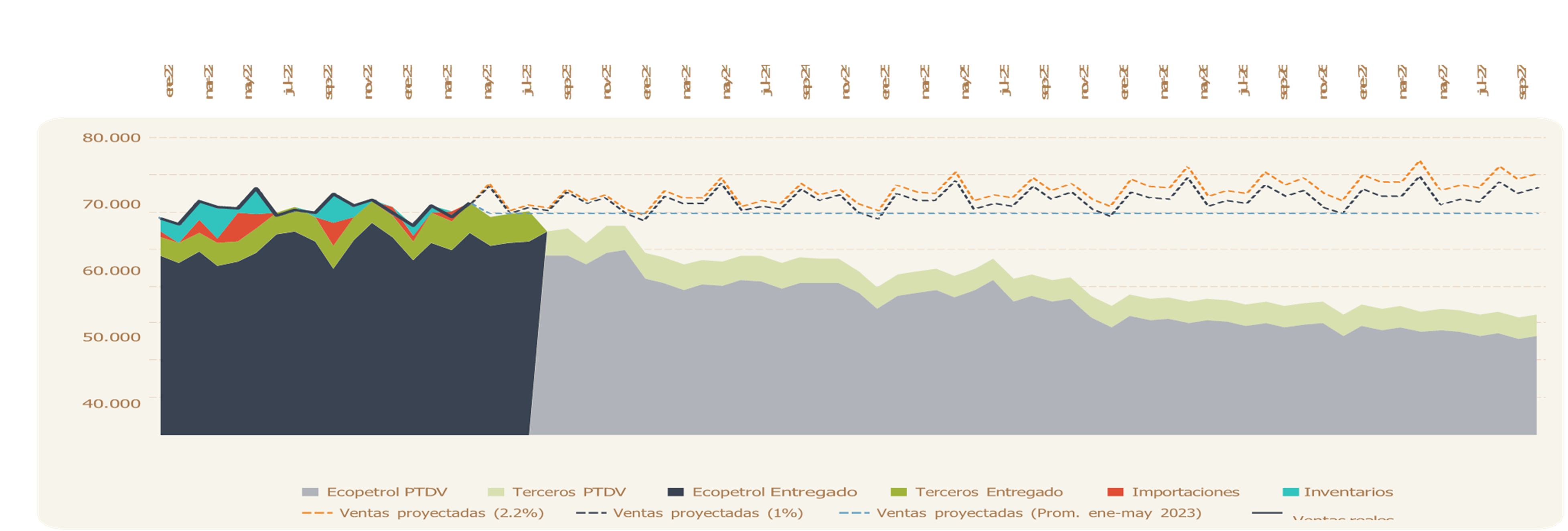

In July 2022, the Colombian government, through the Mining Energy Planning Unit (UPME) published projected LPG demand using a generalized additive model (GAM). GAMs, are adaptations that allow us to model non-linear data while maintaining explainability of two or more variables. This projection model estimates LPG consumption will show a growing trend for the period 2022-2035. The expected average annual growth is 2.2% during this period.

Potential Demand Scenarios Based On Projected Growth Rate.

Faced with these demand projections, Ecopetrol (Colombian State Oil & Gas Company) created three demand scenarios.

- The high demand scenario corresponds to a 2.2% growth rate.

- The medium demand scenario corresponds to a growth rate of 1%.

- And the final scenario considers constant growth based on the average of sales for January-May 2023.

Based on the production declaration published by the Ministry of Mines and Energy (MME) through Resolution 00644 of July 10, 2023, the projected supply-demand balance would be as shown in the chart below.

Production Decrease Predicted.

This report predicts a decrease in productive hydrocarbon areas based on future planning and on the determination of the supply presented by the different national actors. This decrease (shown as a gap in the chart) will need to be met with imported LPG. There is significant reduction in the availability of LPG while demand continues to grow constantly at a minimum of 2.2% year-on-year.

Need For Imports To Meet Projected Demand.

Even in a low growth scenario, starting in January 2026, Ecopetrol would supply less than 50% of demand. By reducing Ecopetrol’s participation in the national supply, at some point it will no longer have a dominant position. When that occurs, imports will be entitled to a free price (CIF prices).

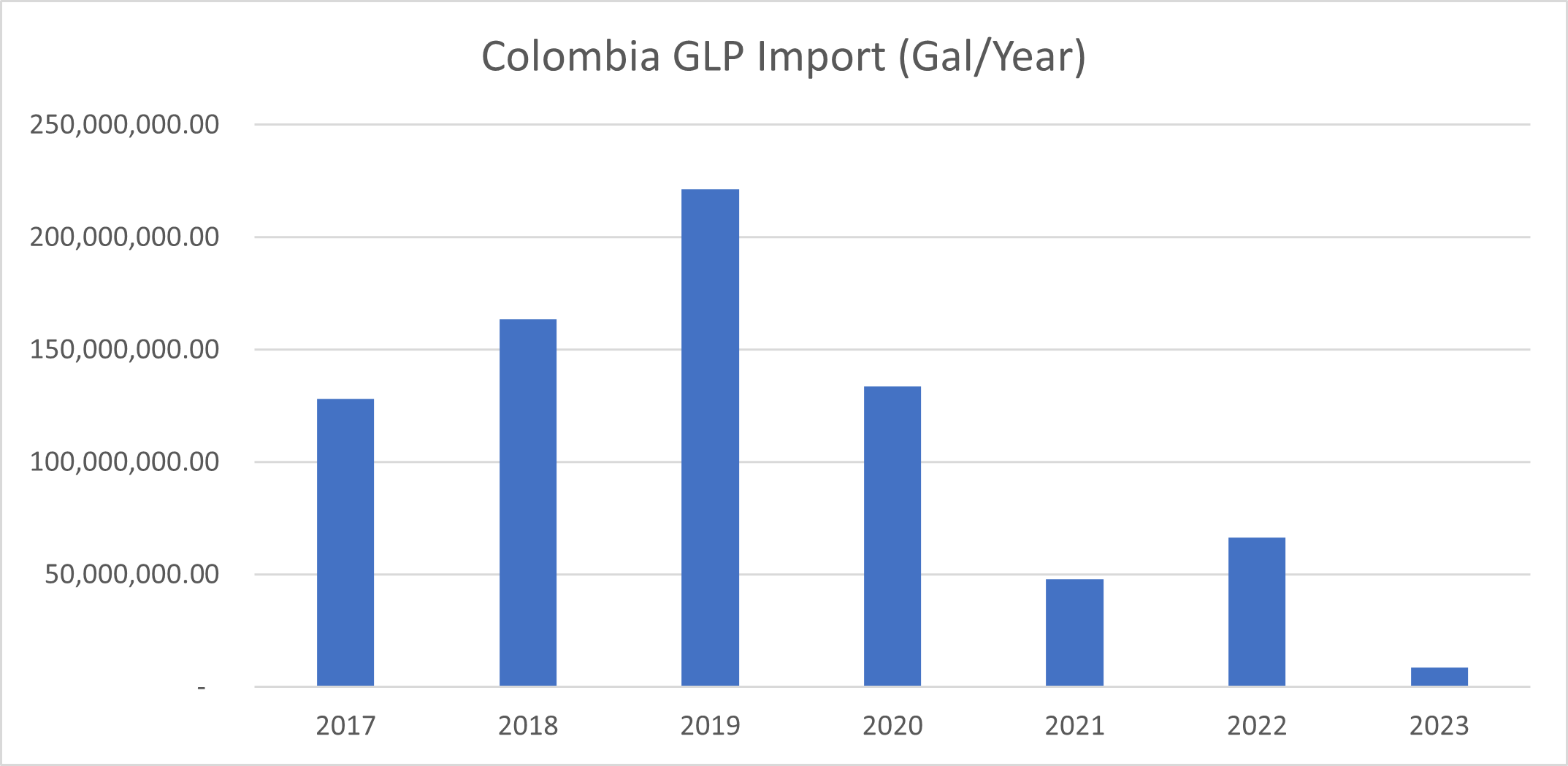

Annual import volumes have decreased significantly since 2021. Domestic actors have tried to reduce LPG shortfalls with products from the domestic market rather than imports. However, as we indicated, this scenario has an inflection point that will be defined from the second half of 2026 or early 2027.

What Does Colombia Need In LPG Terms?

Growing Usage Of Natural Gas And LPG.

Colombia’s usage of natural gas and LPG is constantly growing. The growth rate is reported to be at least 2.2% year-on-year. During 2022, the total market volume was 313.16 MM gal, and user count was 10.2 million.

Opportunities For Investment In This Market.

The gas market has many actors that drive distribution, sales, and marketing of LPG and natural gas. Current reported costs and general consumer prices of LPG present a profit opportunity for companies investing in this economic segment. Additionally, national costs are interrelated with international price indicators (Mont Belvieu).

Supply and demand projection shows a significant gap from mid-2026 to early 2027. At this point the supply will not be sufficient to cover the country’s needs. This gap requires big efforts from external and internal participants to import LPG to cover expected future demand. Colombia may need imports of up to 50% of national demand at this point in time. With such a large demand for imported LPG, international prices (or the free market) will drive the profit opportunity for companies that invest in this market.

Conclusion.

Colombia’s growing energy market, combined with decreased production and an increasing need for imports in the near future, provides the North American energy market with unique opportunities for future growth. If you would like more expert advice on today’s changing energy market, contact a Twin Feathers team member.