Carbon Credit Outlook for 2024

Values fall during latter part of 2023

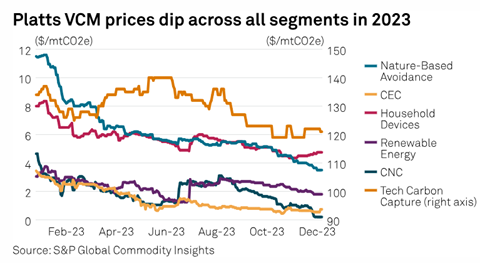

During the latter part of 2023, many of the voluntary carbon credit markets (VCMs) traded in the United States took a dive. From June to end of December 2023, the Nature Based Carbon Offset (N-GEO) contract lost 80% of its value and started 2024 looking weak. Will there be a rebound this coming year?

S&P Global kicked off 2024 with this statement: “with market participants pessimistic about a swift recovery after questions arose regarding the integrity and credibility of nature-based REDD+ credits issued by Verra.”

To further illustrate the impact on carbon credits, this graph was provided:

Will carbon credit values keep falling?

Fast forward to the middle of February and we see European carbon credits reaching the lowest price since October 2021. What was the cause of this move? Oilprice.com stated that “prices began to tumble last year amid low demand and weaker industrial activity, while renewable power generation continued to surge.” (https://oilprice.com/Latest-Energy-News/World-News/EU-Carbon-Prices-Tumble-to-More-Than-Two-Year-Low.html)

Does this mean that carbon credits, specifically European credits, will keep falling? The CEO at Clean Energy Transition LLP believes they will. “A flood of renewable power, combined with falling gas prices and a recovery in nuclear and hydro plants will keep the pressure on carbon [credits].”

What this means for carbon credits in 2024

In prior years, high carbon credit/allowance values helped to drive additional investment in renewable fuels and away from carbon-based fuels. The current dive in carbon credit values could mean that prior year high prices are actually working OR could be providing an opportunity to further delay carbon reduction.

Either, or both, may be true. For our clients though, we see these lower carbon credit prices as an opportunity for a cost-effective way to integrate them in your existing fuel portfolios.

Carbon Credit Outlook for 2024

By JD Buss