Steep Fees on Chinese Ships Could have Extreme Impact on LPG Industry

Tariffs (our current event from last month) remain front and center as we enter the month of March. Discussion about what is going to happen with tariffs continues to dominate the news cycle. We agree that tariffs are an important issue. However, today we would like to discuss another action from the Trump administration that could have extreme impacts on the global maritime industry.

Plan to Target Chinese Ships Would Affect Non-Chinese Operators

In an article written for the Lloyd’s List website on February 22, 2025, Greg Miller outlined a proposed action listed in the Federal Register on February 21, 2025.

Mr. Miller’s article stated that the action listed in the Federal Register was a “response to the United States Trade Representative (USTR) investigation into Chinese shipbuilding and maritime practices initiated in March 2024 at the behest of U.S. labor unions.” He went on to say that the investigation determined that “China engaged in unfair practices.”

This action will impact three major groups:

- Chinese vessel operators

- Vessel operators with Chinese-built ships

- Vessel operators with ships on order in China

Any one of those above categories could be charged up to $1 million USD or more for the vessel making a U.S. port call.

At the end of the article, Mr. Miller outlines how the SHIPS for America Act – a bill introduced in the last U.S. Congress- and this new Federal Register rule would also lay out a multi-year increase in the export of U.S. products via U.S. flagged vessels.

The State of American Shipbuilding

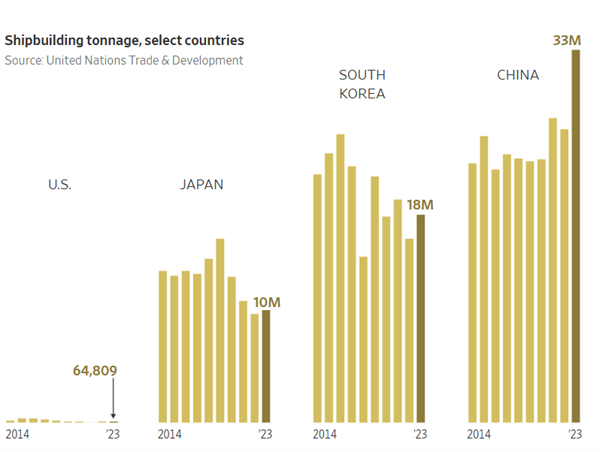

Before we look at the implication of this act, we need to review a Wall Street Journal article from March 2, 2025: “In Shipbuilding, the U.S. Is Tiny and Rusty”. There are two things we want to focus on. The first relates to this graph:

U.S. Shipbuilding Has Been Negligible

The graph above demonstrates that U.S. shipbuilding has been negligible, to say the least. This is true whether we look at the comparison in present day or just over a decade ago. The graph also shows that Chinese shipbuilding has commanded the global landscape. Lest one think the lack of U.S. shipbuilding has been merely a recent occurrence, the article points out that in the 1970s the U.S. accounted for only 5% of the world’s tonnage.

U.S. Shipbuilding is Expensive

The second noteworthy fact was the comparison of a U.S. shipbuilder’s cost in September 2025 to construct three small box ships for container shipment. A Philly shipyard got the order for $355 million per ship while a similar build in China would have been near $55 million per vessel and roughly $200 million in South Korea. U.S. costs coming in roughly 6 times more than China support its limited global market share.

Conclusion

The ideas in these two articles seem consistent with the mantra the Trump administration has laid out in other areas. However, the implications for the energy sector could be very far-reaching.

- Fees for all the Chinese-connected vessels making a port call in the U.S. have the potential to drastically increase overall U.S. product costs.

- A resurrection of U.S. shipbuilding will take more than four years of the current administration.

It could take multiple decades to a full century. This implies that these types of fees would need to be present for an extended time in order to support the growth of the U.S. shipbuilding industry.

Specific implications for the LPG markets:

- 1. Higher costs for loading export vessels at U.S. ports.

This could be a cost forced on the product producer, which could lower domestic LPG costs; OR this could be a cost forced on the end user in another country, thus raising international prices and allowing domestic North American LPG costs to remain high.

- 2. While it is a limited amount, inbound LPG to the U.S. (which would encompass the New England markets and U.S. islands) could see higher product costs with these fees.

The LPG market has become global and the U.S. position as the leading exporter of LPG means any maritime fees could have ripple effects across the continent. This is an important issue for the energy industry and, as such, Twin Feathers will be watching it closely. If you are interested in information that you can trust about current events like this, contact a Twin Feathers team member today!

Current Events – March 2025

By JD Buss